In the United States the provision and payment of healthcare can often be confusing. There are an ever-changing array of healthcare plans, networks, and benefits, not to mention the complexity, staged roll out and political distortion surrounding the Affordable Care Act of 2010. Making choices related to treatment options and which healthcare provider to see can be daunting, especially when it comes to unpredictable variables and your hard earned dollars.

Why Do We Use Healthcare Insurance?

Health is unpredictable; there are no guarantees that you will be lucky enough to avoid an injury or illness. Being responsible with your lifestyle can place the odds more in your favor, though illness and disability can strike you or your family at anytime. Not only is the timing of illness generally unknown, to what magnitude is also variable. To illustrate this, ask yourself a few questions to predict occurrences for the next year or two.

• How much care will you need?

• Will you need an ambulance?

• Will you need imaging such as x-rays or MRI?

• Will you need other diagnostics such as blood work or lab tests?

• Will you need a hospital stay?

•Will you need a surgery?

•Will you need services such as physical therapy or home care?

• Working-age adults made an average of 3.9 visits to doctors, nurses or other medical providers

• Medical provider visits become more likely with age, as 37 percent of young adults 18 to 24 did not visit a provider at all during the year, compared with 8 percent of those 65 and older

• More than half of the population (57 percent) did not take prescription medication at any point during the previous year, while 35 percent reported taking it regularly. While 80 percent of older adults (those 65 and older) reported regular prescription medication use1.

Why Does Healthcare Cost So Much?

Imagine one hundred years ago, a family member on a family farm falls ill and the local physician is contacted. The doctor would be paid by the family to offer his or her services in caring for the ill family member. If the family were unable to pay in cash, often bartering of items possessed by the family would be used for payment, products such as chickens or eggs. Today, bartering may continue in isolated cases, however many things have changed over the past one hundred years and most providers no longer accept chickens as payment.

Due to research, specialization and advancement of technology payment for healthcare services moved from bartering and fee for service model to what is known as a 3rd party system in effort to spread the financial risk in case of a catastrophic medical event. Research, development and production are not free, and again largely take place in the free market. Taking the example of cancer diagnosis and treatment, the American Cancer Society estimates 1,655,540 new cancer cases in 2014. With over 580,000 deaths/year, cancer in all its various forms is the second leading cause of death in United States. Certain forms of treatment for leukemia can cost

$138,000/year, and that is just for the chemotherapy alone, not including the expense of operating medical facilities.

The technologies and dissemination of knowledge to first diagnose then treat various diseases, dysfunctions and injuries have been costly, and the consumer eventually absorbs this cost.

Calculated Risk

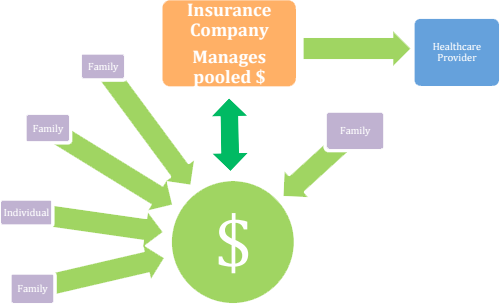

So why do we have healthcare insurance? Pooling resources such as money with a manager spreads the financial risk of getting sick across a large group of people. In a sense, we all contribute money to a fund in relatively small amounts, known commonly as a monthly premium, in hope that a medical event will not bankrupt an individual. Insurance companies are entities that manage these funds, while also statistically ensuring a profit for doing so.

If a medical event occurs with you or within your family, and odds are that this will eventually happen, the risks can be high for all parties involved.

Individuals & Families

Risk: Catastrophic medical event, illness or congenital condition resulting in financial ruin

Healthcare Providers

Risk: Patients who are unable to pay for the cost of services rendered resulting in loss of income / business / services available to community

Third Party Payers / Insurance Companies

Risk: Individuals over utilizing medical care and draining the pool of money and Insurance Company profits.High-risk policyholders such as sedentary or smokers who have a more frequent need for healthcare and ultimately increase the cost to all Individuals misusing expensive services such as utilizing the Emergency Room for non-life threatening situations

By utilizing healthcare insurance, all involved can reduce their financial risk. With healthcareinsurances companies having the role of managing capital, various methods have evolved over the years to help reduce their risk.

There are several mechanisms developed by insurance companies to better hedge their financial risk in the management of healthcare. A premium is the consumers out of pocket cost, usually per month, paid into a managed pool of funds. In order to maximize profit, the insurance company uses devices within agreed upon terms of an insurance contract. Here are a few examples of these risk-reducing controls:

Deductible

• The amount that the subscriber incurs before a health insurer pays for all or part of the remaining cost of the covered services

• Linked to a time period (usually 1 year) and starts over on a specific date regardless of expenses for that year

• Higher deductibles are often due to lower monthly premiums

• It is illegal for a medical provider to wave or discount this fee when billing an insurance company for services rendered

Copayment

• Flat dollar amounts ranging from just a few dollars to over $50 a subscriber must pay for specific health services (office visit) at the time of service

• This is in place to discourage the consumer from seeking services often

• It is illegal for a medical provider to wave or discount this fee when billing an insurance company for services rendered

Coinsurance

• Usually presented as a percentage (80/20%)

• A cost sharing agreement under a health insurance policy

• The subscriber is required to assume responsibility for a % of the cost of each event, service or office visit

• It is illegal for a medical provider to wave or discount this fee when billing an insurance company for services rendered

Capped Benefits

• A stop-loss for insurance companies of their out of account expenses related to an individual’s medical care

Preauthorization

• Permission to proceed by the insurance company in order to determine if the services are necessary regardless of an individuals wishes

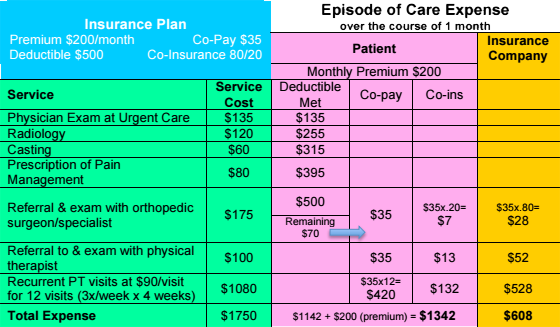

To illustrate how these devices come into play, the following example is presented as a general concept; pricing and insurance coverage parameters will vary with specific plans:

An insured individual is covered under a health insurance policy with monthly premiums of $200,has a $500 deductible, $35 copayment and 80/20 coinsurance. The individual sustained a wrist fracture that required casting and has been prescribed much-needed physical therapy immediately after removal of the cast. At the time of the visit, and each visit thereafter, the person must pay the $35 copayment. The following chart demonstrates a comparison of expense for the patient and their insurance plan.

To simplify the above case it is a snapshot of a single episode of care over the course of one month. Over the entire policy year, the patient would have paid a total of $2400 in premiums to the insurance company.

Private insurance companies also will contract with providers to ensure a more predictable charge for service. This approach is often given a title to make it sound more appealing to the consumer and is generally known as “In-Network” or “Preferred Providers”. These networks are not based on the skill, experience or knowledge of the provider, but rather the dollars and cents of the insurance company.

To the medical provider, this network is known as a panel. The medical provider is required to be paneled in order to participate in a network. To reduce liability, the insurance company will also require the provider to undergo credentialing. Credentialing is a term used for a process similar to a background check. This is to assess risk by investigating if the provider has had past issues such as involvement in legal disputes, moral turpitude or substance abuse.

• Consider your Out of Network benefits on your current plan, keeping in mind the separate and usually higher deductible

• Consider a private or self-pay option commonly made available by providers. Depending on the complexity, frequency and duration of your care this may be less expensive than your In Network option

• Most private insurance companies have procedures that allow an insured patient to petition having their provider moved onto the In-Network or Preferred Provider list. However it is common that these proceedings are arduous and usually end in denial

Many consumers believe that their healthcare decisions are between themselves and their medical providers. However, with networks, covered procedures, and financial controls in place, insurance companies assert a large influence on healthcare decision-making. The use of networks for healthcare delivery obviously gives insurance companies influence or decision-making control over the utilization (the delivery and cost) of healthcare services.

So the question remains; why would a provider choose to participate in a system that has some control over the delivery of the provider’s services?

Regrettably most patients choose their provider based on their insurance network listing, while the skill and outcomes of the provider play a far lesser role in the decision. Providers are at risk of loosing patients to competitors by not participating in a variety of insurance networks. This is the primary reason behind provider participation in insurance networks.

Why are some medical providers not on a particular insurance network?

Some providers find the reimbursement for services offered by a particular insurance company to be too low in order to operate successfully and choose to opt out of a network. More often however, insurance panels/networks close to providers if the insurance company deems a particular community as having adequate services. In other words, the insurance company can also control the number of providers available to a population. Insurance panels also may be closed to providers who are not employed by a parent entity, such as when an insurance company owns a hospital network. This is done in effort to control the flow of money as the patient moves through various stages of treatment, in a sense, keeping money within the same corporate entity throughout the entire course of patient management.

How are healthcare providers reimbursed for services through insurance?

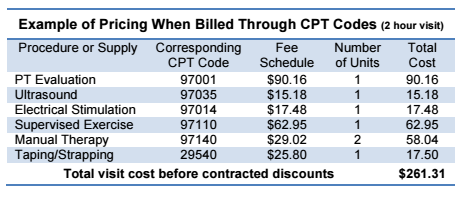

Each year, the American Medical Association issues a list of descriptive terms and numerical codes for reporting medical services and procedures performed by physicians. The resultant database—called Current Procedural Terminology—is then incorporated into manuals published by the AMA, insurance companies, and commercial publishers. These codes are referred to as "CPT codes." Whether a service is covered depends on the contract between the insurance company and the insured person. This common system of reimbursement for services following care provided is known as retrospective payment, meaning services are broken down into each individual procedure or supply, charged separately and billed after the care is provided. This system breaks services down into an a-la-carte pricing approach. The majority of insurance companies reimburse healthcare providers using this system, instead of a flat rate, per visit price.

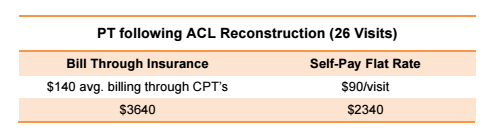

The question often arises; why would anyone consider paying for healthcare services “out of pocket” when they have medical insurance coverage? The answer is simple, total cost by the end of treatment.

Taking an example of an individual who has a $3,000 deductible, none of which has been met, and they are prescribed physical therapy. It is highly unlikely that the total course of physical therapy prescribed will cost more than $3,000. Therefore this individual will be required to pay the total cost of care until the $3,000 is reached, then further treatment would be paid according to the insurance plan they chose. This could also result in continued cost beyond the $3,000 deductible already paid, such as with 20% co-insurance as well as per visit co-pays. If the individual decides to pay for visits toward the deductible, their insurance company will likely process the cost of each visit through the CPT coding method, with each aspect of the treatment charged under a set fee schedule. This results in a single physical therapy visit often costing over $140.

Many healthcare providers also offer patients a flat rate amount per visit. This rate is often far below the total per visit if calculated by CPT codes of services rendered. Therefore if physical therapy or other services are predicted to be less than the deductible amount, an out-of-pocket, self-pay flat rate will result in a significantly reduced cost to the patient. The table referenced to illustrate this uses an example of rehabilitation following an ACL reconstruction, which usually requires several months of physical therapy intervention.

Private practice clinics have the ability to offer a flat rate lower than CPT coding fee schedules due to several factors. The most obvious influences on cost reduction related to flat rate billing include reduction of staffing required, hours worked and processing fees. If the patient chooses to self pay, the treatments provided are not beholden to the fees schedules dictated by the insurance providers, this also can drive cost down. For these reasons, and to simply “cut out the middle-man headaches”, many private healthcare providers are now self/private-pay only and no longer accept insurance payment at all.

If the patient chooses to run the cost of treatment through their insurance, the treatment billing is processed as stipulated by the insurance company and removes the ability of the medical provider to discount services. In fact, it is illegal for a provider to discount any portion of the patients’ payment if billing is processed through their insurance. This federal mandate is part of the False Claims Act or “Lincoln Law”. Violations of the FCA are implications of fraud and abuse, punishable by a $5000 per claim fine and imprisonment. Therefore medical providers are unable to lawfully offer their lower flat rate payment as payment toward the patients’ deductible or discount any portion of copayment.

Decisions, Decisions

It is common practice that a minimum portion of estimated cost is paid at each visit if the patient chooses to process through their insurance plan. It is also standard practice that once an insurance plan is billed for services rendered, the process cannot be reversed. In other words, the patient must decide at the start of their care if they are to utilize their insurance benefits or a self/private-pay method if offered by the provider.

It is highly recommended that patients understand the insurance plan they or their employer chose in order to make informed and intelligent decisions regarding the cost of healthcare services they seek. Now with healthcare insurance being required to avoid a tax penalty in the United States many self-funding individuals and families are choosing high deductible plans. This notion is commonly referred to as a Catastrophic-Plan strategy. If you are relatively healthy and do not anticipate any significant expense over the coming year, spending on a high premium plan may not be necessary. Instead, many choose a low premium/high deductible plan and simply pay out of pocket those expenses that do not accrue close to the deductible amount. Using this strategy can save thousands of dollars per year though does come with the risk of an unforeseen major medical event being privately paid until the deductible is met.

A Few Words About the Affordable Care Act of 2010

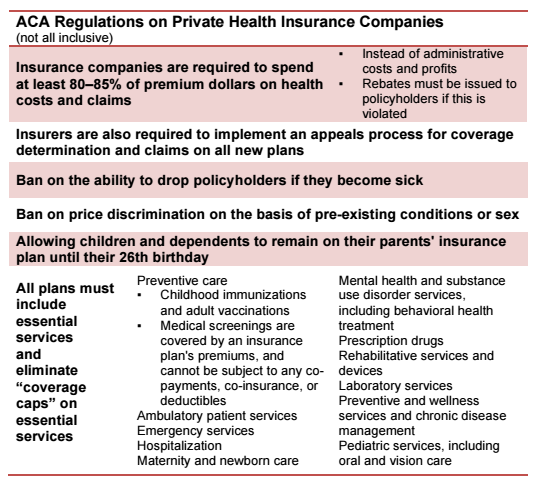

Fortunately to ease stress in making these decisions, the Patient Protection and Affordable Care Act signed into law in 2010 has established improved consumer protection in the private healthcare industry. This law attempts to improve a complex marketplace for and protect the healthcare consumer and in itself is a lengthy discussion. Because of this, only the aspects of the law that are relative to choosing a health plan as reflected on in this article are presented.

With the Affordable Care Act, the federal government has made comparing and purchasing private health insurance easier by comparing figurative apples to apples. The resource website available to all, www.healthcare.gov, organizes insurance plans available in your area so the division of cost can be easily compared, much like nutrition labels on food products.

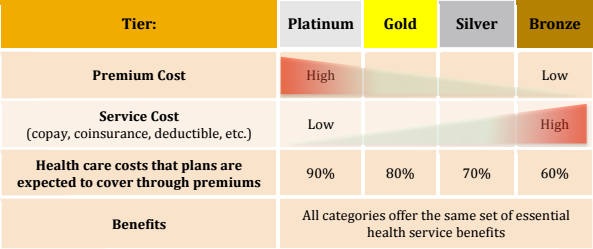

As it has been for decades, the higher the premium, generally the lower the deductible and copay/coinsurances. The following table demonstrates this concept using the color-coded tier system as with healthcare.gov and some state exchanges.

Escalating cost has also been partially stemmed by requiring insurance companies to spend at least 80% of premiums collected on healthcare claims as well as subsidies offered by the government to those who legitimately cannot afford insurance. For brevity, the corresponding table demonstrates some of the now mandatory benefits of all private healthcare insurance policies. With essential services included with all plans the complexity of choosing a health plan is again reduced.

Individuals and families are driven into participating in a healthcare insurance policy due to the financial risk of medical care as well as stipulations of the Affordable Care Act of 2010. How a consumer does continue to create influence on the delivery of healthcare is in their choice of their health plan from groups of competing insurance companies. This creates competition in the free market and incentivizes insurances companies to offer lower rates.

For additional information regarding of the Patient Protection and Affordable Care Act, please visit www.healthcare.gov

Knowledge Is Power

It is recommended that you know the parameters of your chosen health plan and speak with your healthcare provider regarding anticipated frequency and duration of treatment to make well-informed decisions regarding your care and anticipated cost. As a courtesy, Active Lifestyles Physical Therapy verifies each patient’s insurance plan benefits in effort to clarify cost and expectations.

An informed patient typically experiences better outcomes physically, financially and emotionally over those who consume healthcare blindly. The delivery of healthcare in the United States is a service provided by caring professionals with sincere intentions to assist you, however is it largely a business with many players with profit in mind. The scope of which is massive, healthcare being 17.2% of GDP, costing $9,523 annually for every person currently residing in the United States. Healthcare is the largest segment of consumerism in the country, and just as with any other industry, it is a “buyer beware” realm. How you choose and use your private healthcare insurance can make a significant impact on your bank account.

The healthcare landscape has had several dramatic changes over the past few decades and continuation of this evolution is inevitable. As clinicians concerned with maximizing the value of services for our patients, we remain apprised of these changes and structure our clinic to provide the highest benefit to you. To keep physical therapy services available and affordable, Active Lifestyles Physical Therapy offers the lowest private-pay flat rate physical therapy services in our region and is paneled with most insurance plans.

If you have questions regarding your current insurance plan or payment options available to you, please feel free to ask our dedicated office staff for straightforward and candid assistance.

Author: Christopher Harper, PT, DPT, OCS

October 2012 Revised: July 2016

Health Status, Health Insurance, and Medical Services Utilization: 2010

i According to the Department of Health and Human Services (HHS), Office of Inspector General (OIG), "It is"